It is no secret that data is an enormous part of business. We all thrive in environments that have access to good data. Marketers can market better, sales can sell better, operations can understand their businesses better, IT can analyze data to secure better. Overall, the business thrives when we have viable data. The downside is the risk it creates. With the possibility of a breach there is the potential to not only hurt businesses financially but reputationally causing angst amongst the very people whose loyalty builds our brands.

While data is a core component of business, it also is what creates the desire for bad actors to work their way into our environments, searching for personal information of our customers, our employees, and trying to gain access to critical assets for monetary gain or to steal trade secrets, code, or other valuable crown jewel information. Therefore, it is more important than ever to understand the various hazards that reside within your business, whether the risk impacts compliance, security, operations, finance, or reputation.

Regulatory pressures are amassing globally and impacts how we align our businesses.

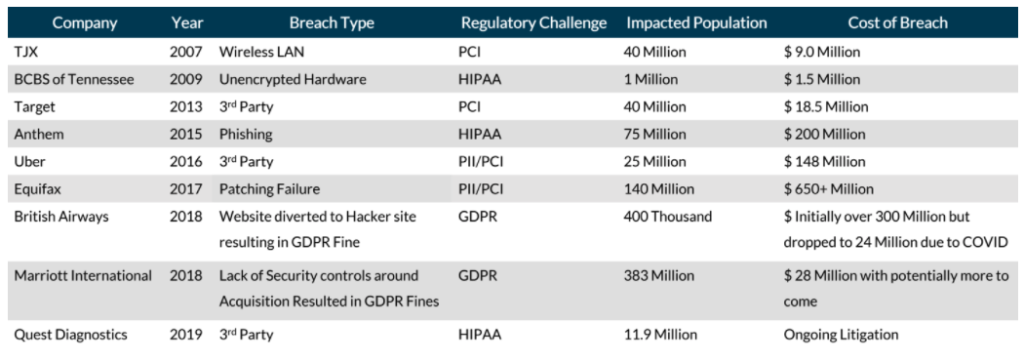

- For example, here in the US with the CCPA (California Consumer Privacy Act) and in the EU with the GDPR (General Data Protection Regulation), these regulatory measures have forced organizations to better align security controls with data privacy practices. Massive fines have been levied against companies that do not comply with the regulatory measures and neglect the responsibility of protecting consumer data.

A company can spend tens of millions of dollars on technology in the hopes of hindering threats, but technology alone is not a silver bullet. The truth is, the example breaches noted above could have been prevented with the right mix of good processes, technologies, and the right skillsets to make sure both are set up correctly.

- Technology can be great at helping identify where risks lie, but it is only useful if we know what to do with that information. With many of the identified breaches, a strong third-party risk management program could have helped these organizations prevent much of the loss.

For instance, matching risk scoring services with cyber teams, vendor teams, and operations can help gain visibility into where risk lies both internally and with external parties. Businesses cannot rely solely on technology and need to align the proper due diligence to ensure a better security posture. Setting up a third-party risk management program often involves understanding vendors on a deeper level, assessing them periodically, and ensuring that risk is acceptable to the business.

- What often gets lost is the people and process aspects. How can we fully understand the risk if we do not understand who has access to the information we share with our vendors and third parties?

- How can we get a full picture of risk without having a remediation plan in place should we find something out of the norm?

These are things that need to be factored into our process if we are going to grasp all areas of third-party risk management. The blind spot of third-party risk lies in understanding who has access to your data from the outside.

Incorporating this into your strategy will highlight what vendors pose a greater threat based on the information they have access to, their commitment to similar security protocols, and their ability to ensure best practices are taken by employees that access your environments.

- Many breaches have started through third-party relationships. It is extremely important to not turn a blind eye to identities.

Defining Our Risk Mitigation Strategy

Security and data privacy have collided. Risk management and cybersecurity professionals must work together not only understanding how to map the security controls to the regulatory requirements but, how this may impact the business. Collaboration between various business lines is necessary to identify and mitigate threats.

- Without collaboration, it becomes impossible for businesses to get a full picture of their risks and bad things follow.

Myna views this as an opportunity for internal teams to collaborate to better understand the need for focus on data privacy, security, and ensuring the business not only complies with regulatory requirements but also understands their data better.

To get a better understanding of risk we need to be asking the right questions as a business:

- Do our security tools help us identify, quantify, and manage risk?

- Are we aligned as a business to comply with various regulatory measures, and do we have a clear understanding of these measures?

- Do we have the transparency as to who has access to sensitive data both internally and externally and do we know if and why that access is appropriate?

- Do our employees, vendors, and contractors understand the importance of risk and security, and do they possess the skillsets to impede risk?

- Do our vendors have the right level of security so that we feel comfortable working with them?

To obtain the answers to these questions, and a whole host of others, there needs to be better collaboration between business lines to understand risk. This, mixed with assessments of our security controls, processes, procedures, and a clear map of how we are aligning our controls to meet regulatory requirements and keep us secure, is a great start.

- Cybersecurity and data privacy are colliding, and it is more important than ever to leverage knowledge across the business to understand risk holistically.

It does not matter if your business is a 5-person startup or a Fortune 500, risk is always there. If you promote collaboration, you put your business in a much greater position to not only improve your security posture but help build awareness of what risks are associated with today’s data-driven world.

In these times, if you are like most organizations, you are being asked to do more with less. If you are struggling to get your arms wrapped around of the vast landscape of risk, you are not alone. Clients around the globe rely on us to help them identify, assess, and mitigate their risk.

- Are you looking to gain a better understanding of where risks reside in your organization?

- Are you heavily regulated and looking for outside help?

- Are you ready to get your controls aligned well to your business and regulatory measures?

- Would you like clear visibility into your vendor environment? We can help.